The bookkeeper for all entrepreneurs

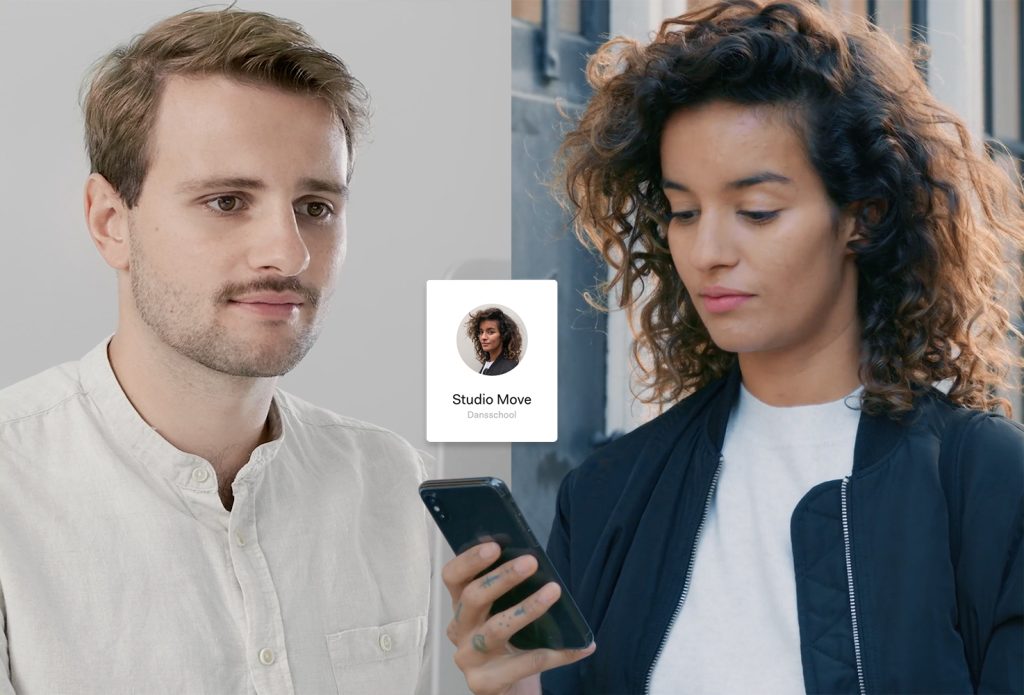

Team up with your bookkeeper

The Bookkeeper

Your personal bookkeeper for all your tax declarations and questions

Administration and VAT return

Your bookkeeper checks your administration and takes care of your quarterly VAT return

Income tax

Your bookkeeper prepares your financial report and submits the income tax return

Always available

Questions? Your bookkeeper is there for you

Everywhere

Our bookkeepers work for all entrepreneurs in the Netherlands from our offices in Amsterdam, Rotterdam, and Utrecht

The tool

View your income and expenses, send invoices and offers and save your important documents. All in one place.

Online tool with zero-learning curve

Administration overview

Everything transparent and orderly in your account

Invoices and quotations

Send invoices and quotations using the tool

On time for tax declarations

Get reminders for important deadlines

Profiles

A network of professional creative entrepreneurs

The rates

A fixed annual rate, invoiced monthly.

Rates

Sole proprietorship

A full fiscal year, invoiced monthly.

Vof (general partnership)

A full financial year for 2 people, invoiced monthly.

Holding BV

A full fiscal year at Founders invoiced monthly.

Operating company

A full fiscal year at Founders invoiced monthly.