Tax deductions for freelancers (zzp) in 2026: your ultimate guide

Whether you’ve just launched your business or have been in the game for years, you want to know exactly where you stand when the tax return letter lands on your doorstep. That “blue envelope” is a fact of life in the Netherlands, but it doesn’t have to mean you’re only sending money away. On the contrary: the tax return is the prime moment to claim your fiscal benefits. Fortunately, there are several entrepreneurial deductions waiting for you, ensuring you get to keep more of your hard-earned money.

Charging expenses to your client

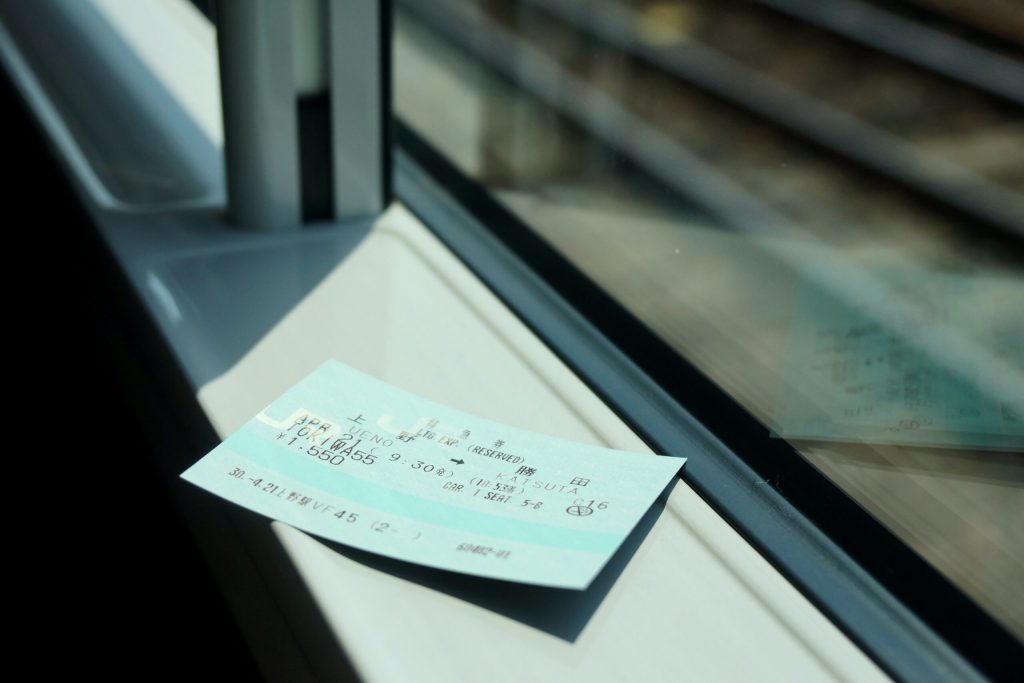

When you’re working on a project for a client, you’ll likely run into extra costs. Things like travel expenses, such as taxi or kilometers, but also materials, literature or shipping. If you’ve agreed with your client that these expenses can be reimbursed, you’ll need to include them on your invoice. But how do you handle these costs in your bookkeeping?

When can you call an expense an investment? And what does that exactly mean?

Your business is running smoothly! So it’s time to really invest in it. Of course you put in your time and you may be doing a course to become even better at what you do or you might buy the latest MacBook. But what exactly is an investment? And are there any pros or cons when an expense is an investment?

Ready for 2026? – Start the new financial year fresh with this checklist

The end of the year is near – the perfect time to get everything in order and step into 2026 well-prepared. This checklist will help you finalize your administration, so it’s ready to hand over to your bookkeeper. Collect all invoices you’ve sent out and upload them to your online administration. Also, check if…

Tax interest

Your income tax return has been submitted and three months later you will receive a tax assessment. The amounts to be paid on that assessment all correspond to what was stated in the tax return, except that there may be an extra amount, which you cannot place directly: tax interest… What is tax interest?Tax interest…

Is a bookkeeper mandatory for freelancers (‘zzp’ers’)?

As a freelancer (‘zzp’er’), a lot comes your way. You’re busy with your profession, clients, and assignments. And then there’s the administration… Do you, as a freelancer, have to have a bookkeeper? Or can you just as well do it yourself? Many entrepreneurs hesitate between…

A company car – wise or not?

As an entrepreneur, you face many choices, and your car is one of them. Do you use your private car for your business, or do you register a car as a company asset? This is a question that occupies many freelancers in the Netherlands. After all, you want to seize every opportunity to save costs, but at the same time, you need to follow the rules. Good news:…

Business phone: rules for VAT, depreciation, and private use

As a freelancer (‘zzp’er’), you’re always reachable. Your mobile phone is, therefore, an indispensable tool. But can you simply register your phone as a business asset? And what about the VAT, the costs, and…

Are business gifts deductible for my company? (update 2025)

A thoughtful business gift (‘relatiegeschenk’) can benefit your professional relationships. It strengthens bonds, shows appreciation, and ensures you stay top of mind with clients and business partners. But while you’re…