Averaging for a fluctuating income

You might make a lot more money in one year than in the other. When you have a highly fluctuating income it could be fiscally beneficial to apply for averaging with the Tax and Customs Administration. But how does averaging work exactly and could it be interesting for you?

What is averaging?

The Netherlands has a progressive tax system which means that people with a higher income pay a higher tax percentage than people with a lower income. When your income fluctuates highly you might pay a higher tax percentage over one year than over the other. By averaging you calculate the average income over three years, which means peaks in income are flattened. This way your average income might be in a lower tax rate than your highest income in this period. That means you paid more taxes than you would have paid over that average income. But by averaging you can get a refund from

the Tax and Customs Administration

These are the conditions you have to meet in order to apply for averaging at the Tax and Customs Administration:

- You can only apply for averaging for income from work and living (box 1).

- Averaging can only be applied for three consecutive years.

- Your request for averaging must be filed at the Tax and Customs Administration within three years and six weeks after your final tax statement.

- Averaging must lead to a minimal refund of € 545 or you’ll not be eligible.

- A year with a negative income equals € 0 when averaging your income.

- There can’t be an overlap with another averaging period. Did you already apply for averaging for a certain year? Then you’re not allowed to use that same year for another application of averaging.

Who can benefit from averaging?

Averaging is especially interesting for people with a highly fluctuating income. This means a difference of tens of thousands of euros and not a couple of thousand. For instance when you’re an entrepreneur and you had a very bad year and a very good year or when you’ve been away for a year to travel or when you’ve just started working after graduating and you didn’t have a job while studying. But also if you received a severance pay. These are situations that can cause your income to fluctuate highly.

Example

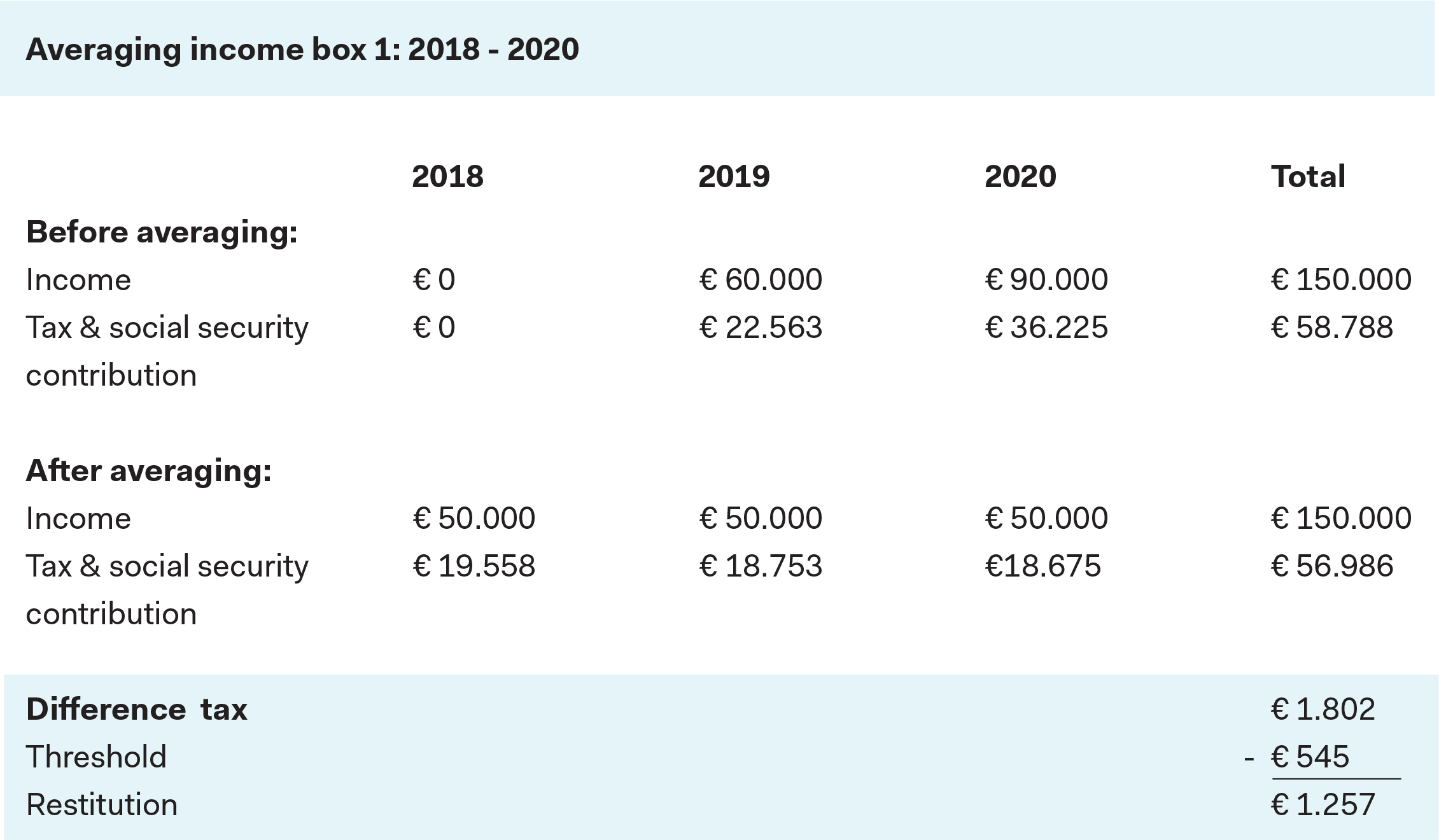

John took a year off in 2018 to go travelling. In 2019 he started working again. Check out this overview of his income and taxes with and without averaging:

In 2018 his income is completely in the lowest tax bracket, therefore he has to pay a little over 35% tax. In 2020 the biggest part of his income is in bracket 1 (till € 68.507), but a fair share of his income is in bracket two. Over this part of his income he pays almost 50% tax. Through averaging the total income of three years is spread out over three years, so the high and low peaks level out. In John’s case: because of averaging his income over the past three years is never in the highest bracket and therefore he doesn’t have to pay 50% taxes over any part of his income. He can claim his benefit back from the Belastingdienst by using averaging.

Regulation has been expired on January 1, 2023

Starting in 2023, the averaging regulation has been discontinued. However, it is still possible to apply regulation to your income tax return until the year 2024. Concrete, this means the following:

- The last years you can apply for averaging are 2022, 2023, and 2024.

- For example, if you choose to average 2022 as the last year (which means you will be averaging over the years 2020, 2021, and 2022), you cannot request averaging for the years 2023 and 2024. You can only average over three following years.

- If you still prefer to apply averaging for 2023 and 2024, you can only do so in combination with the year 2022. Please take this into consideration!

How do you request averaging?

Averaging can only be applied for in the form of a written request at the Belastingdienst. On this form you fill out over which three years exactly you want to apply for averaging and why. Your request needs to be substantiated by a calculation. This way you can show that you in fact are eligible for averaging. The written form is then sent to your tax office. Of course your bookkeeper can also take care of this for you.