Most important changes for self-employed professionals in 2023

With effect from January 1st 2023, several tax rules for self-employed professionals have changed. It’s important to take these changes into account right from the start of the new year, so please read this blog carefully! These are the most important legislative changes for self-employed professionals:

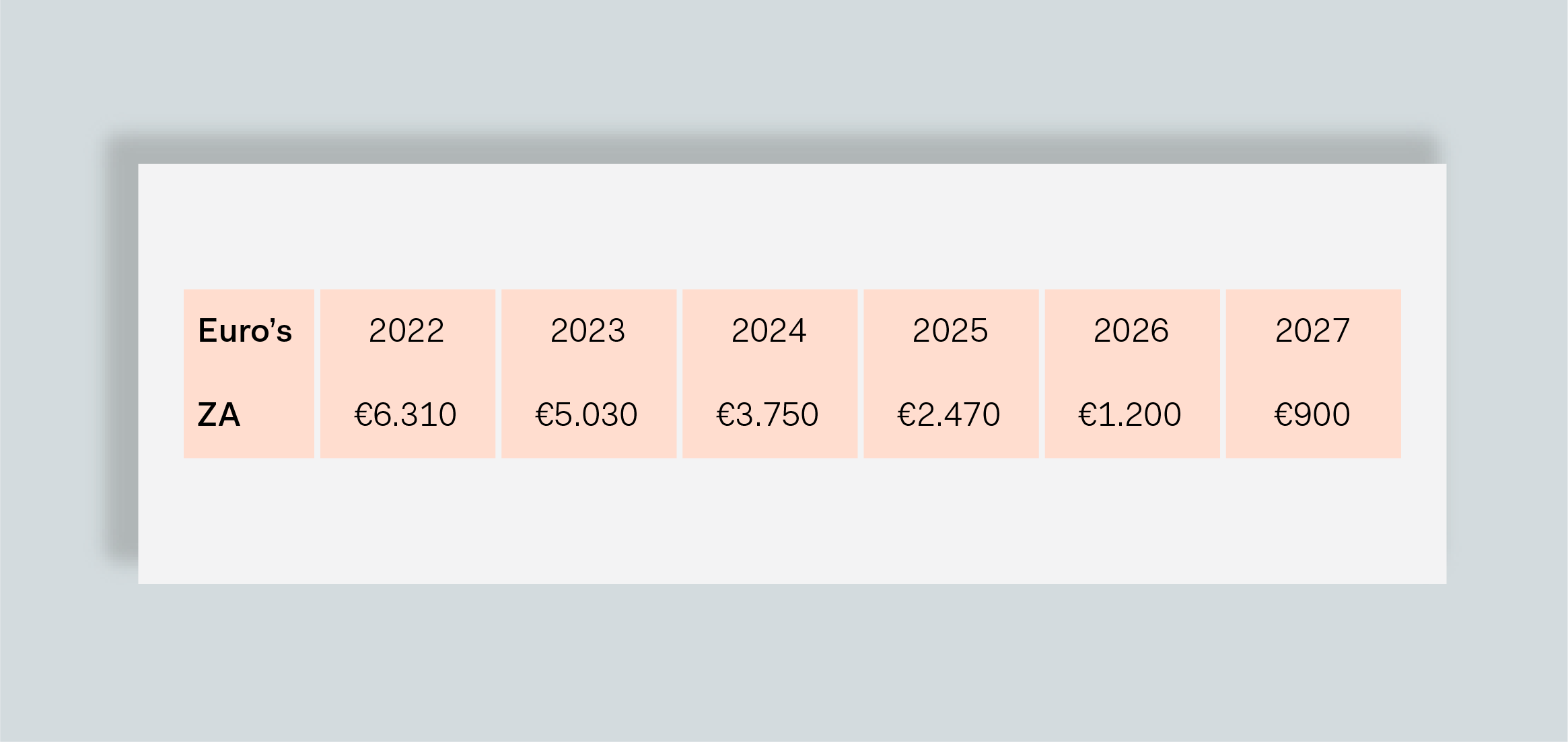

Reduction of private business ownership allowance

In the coming years, the private business ownership allowance (zelfstandigenaftrek) will be reduced and this gradual reduction has already been set in motion. In 2022, the private business ownership allowance was €6,310, for 2023 it has been set at €5,030. Please keep in mind that you must meet the hours criterion in order to be entitled to this allowance.

General tax credit increases

So, the tax advantages of the private business ownership allowance are being phased out. However, at the bottom of the line most self-employed professionals won’t really notice this since the general tax credit will go up, much to the benefit of everyone with an income up to €115,000.

The general tax credit will be increased gradually in the coming years. The credit you receive depends on both your income and age.

Fiscal retirement reserve (FOR) build-up stops

The FOR is a scheme that allowed entrepreneurs to accrue pension by setting aside part of their profits. From 1 January 2023, entrepreneurs can no longer build up this retirement reserve; at least, not through their company. Fortunately, there are many other options for self-employed professionals to build up (extra) pension. The FOR accrued up to and including 31 December 2022 is settled according to the previous rules. So you don’t have to worry about the FOR you’ve already built up!

Bigger annual margin

If you’d still like to set apart money for your pension despite the abolition of the FOR, you’ll need to take the annual margin into account. This margin determines the part of your income you’re allowed to set apart for your pension in a tax-efficient way. From 2023, the annual margin will increase considerably: from 13.3% to 30%, which is great news now that the FOR is abolished.

Increase tax-free travel allowance

As of 2023, the tax-free travel allowance is increased to 21 cents per business kilometre. As an entrepreneur, you can deduct the total amount of all business trips with your private car, motorcycle and/or bicycle from your profit. As of 2024, the tax-free travel allowance will increase further to 23 cents per kilometre.

Healthcare Insurance Premium decreases

As a self-employed professional, you pay an income-related premium to the Healthcare Insurance Act. In other words: the higher your income from your business, the higher your Healthcare Insurance Premium. Compared to employees, a lower rate applies to entrepreneurs. This rate has now decreased by 0.7%: from 5.50% in 2022 to 5.43% in 2023.

Change in stating Payments to third parties

If you’re self-employed and you pay someone who is not employed by you and who’s not an entrepreneur to do a small job for you, you have to submit this under Payments to third parties. From 2023, the process of submitting these costs to the Dutch Tax and Customs Authorities changes.

Abolition of the averaging scheme

The averaging scheme was abolished on 1 January 2023. This was an arrangement for people whose income fluctuated strongly, offering them the opportunity to ‘average’ (proportionately spread) their income over three financial years. The very last time slot for the averaging scheme will be over the years 2022, 2023, and 2024.

New target amount small projects investment credit (KIA)

To be eligible for the KIA in 2023, you must invest an amount between €2,601 and €353,973 excluding VAT in business assets for your company. Previously, that limit was set at €2,401. Please note that something is only seen as an investment if it concerns a sustainable business asset (meaning you will use it for several years) and the purchase value is higher than €450 excluding VAT.

Random depreciation of investments

In the year 2023, there is a monitoring arrangement regarding the provisional

amortization of new investments. These are allowed for

a maximum of 50% of the purchase value is depreciated.The remaining 50% is simply amortized over 5 years.